Kniru

A I • May 07,2024

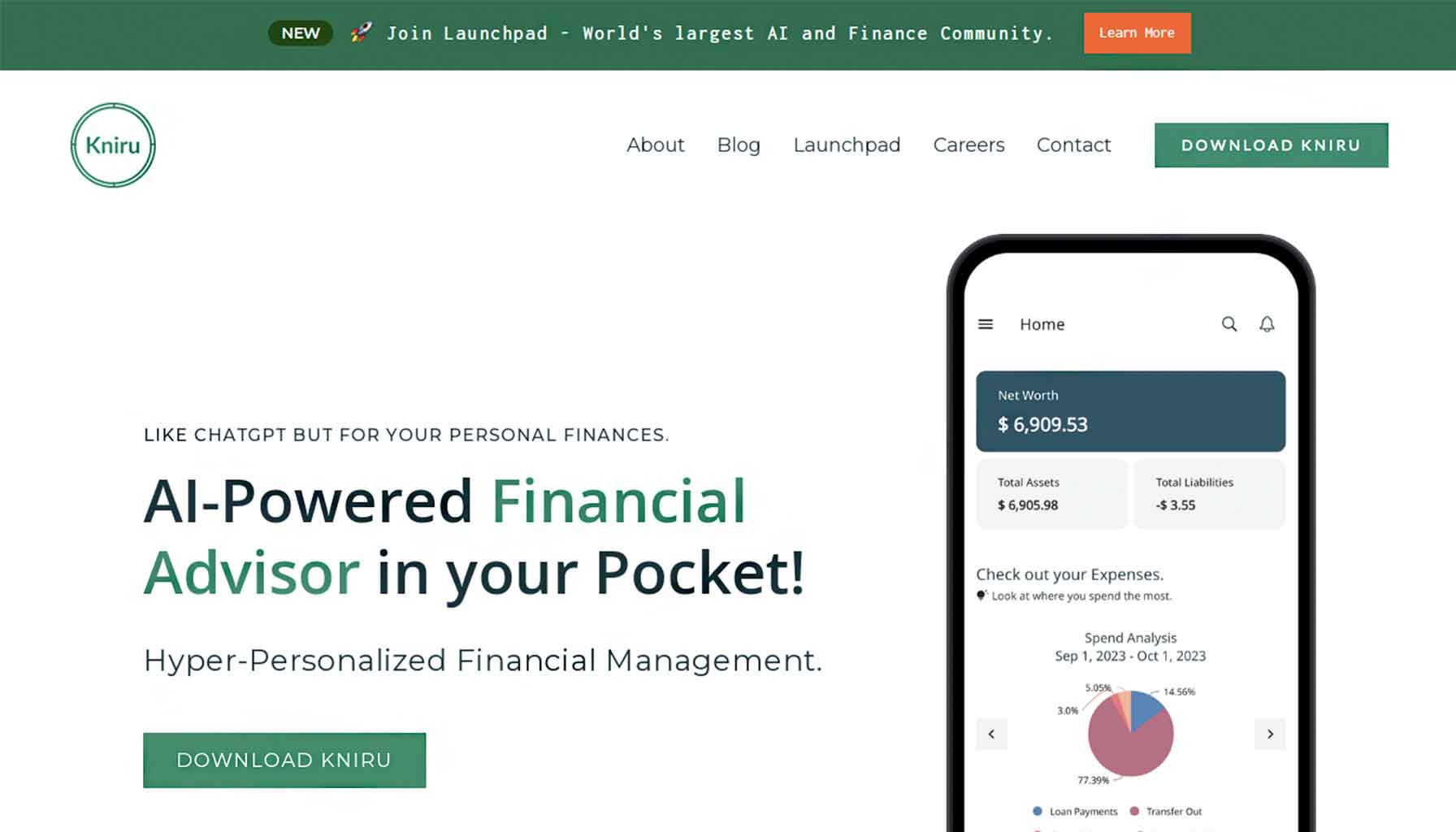

Kniru: Your Personalized AI Financial Coach in Your Pocket

Take control of your finances with Kniru, the AI-powered advisor that’s always by your side. Go beyond generic advice and unlock hyper-personalized financial management tailored to your unique goals. Kniru provides actionable insights on:

● Investments: Make smarter investment choices with Kniru’s guidance.

● Expenses: Track spending habits and identify areas for savings.

● Retirement Planning: Chart your course for a secure future with personalized retirement strategies.

● Taxes: Simplify tax management and potential optimization opportunities.

● Credit Management: Build and maintain a healthy credit score.

Kniru goes beyond insights, offering powerful tools for financial well-being:

○ State-of-the-art notifications: Stay on top of your finances with timely alerts.

○ Personalized savings suggestions: Kniru helps you reach your savings goals faster.

○ Bill reminders: Never miss a due date again.

○ Budget alerts: Manage your spending with real-time budget tracking.

○ Anomaly detection: Kniru identifies suspicious activity in your portfolio for your peace of mind.

Unprecedented Financial Visibility:

○ Seamless account connections: Connect all your financial accounts globally for a holistic view.

○ Comprehensive dashboards: Kniru provides insightful dashboards on your assets, liabilities, investments, real estate, loans, credit cards, and spending patterns.

Key Features:

● Personalized financial guidance: Get a financial plan tailored just for you, not a one-size-fits-all approach.

● Actionable financial insights: Kniru doesn’t just tell you what’s happening, it helps you take control with clear steps.

● Smart financial alerts: Stay informed with timely notifications that matter.

● Connect your financial world: Kniru brings all your accounts together, giving you a complete financial picture.

● Safeguard your finances: Kniru keeps an eye on your portfolio, identifying any suspicious activity.

How to Apply:

1. Grow Your Wealth with Personalized Investing

Kniru goes beyond generic investment advice. Analyze your goals, risk tolerance, and current market trends to create a personalized investment strategy. This helps you maximize your portfolio’s growth potential and achieve your financial dreams.

2. Achieve Financial Stability with Kniru

Managing expenses and staying on budget can be a challenge. Kniru helps you by providing proactive bill reminders, personalized savings suggestions, and real-time budget alerts. These features empower you to make informed financial decisions, build a healthy savings plan, and achieve long-term financial stability.

3. Protect Your Finances with Kniru’s Security Features

Financial security is paramount. Kniru’s anomaly detection feature acts as your financial watchdog. It identifies unusual activity in your portfolio, such as fraudulent transactions or unexpected expenses. This allows you to react quickly and safeguard your assets, giving you peace of mind.

Ideal for:

● Individuals seeking personalized financial guidance: Kniru’s AI-powered financial planning and investment recommendations cater to those who want a tailored approach to managing their finances.

● Budget-conscious individuals and families: The features like proactive bill reminders, personalized savings suggestions, and budget alerts are particularly valuable for those who want to optimize their spending and achieve financial stability.

● Security-conscious individuals: Kniru’s anomaly detection feature for identifying fraudulent or unexpected transactions appeals to those who prioritize protecting their financial assets.

Previos Article Harriet.Ai

Next Article Smith.ai