Unstract

A I • May 30,2024

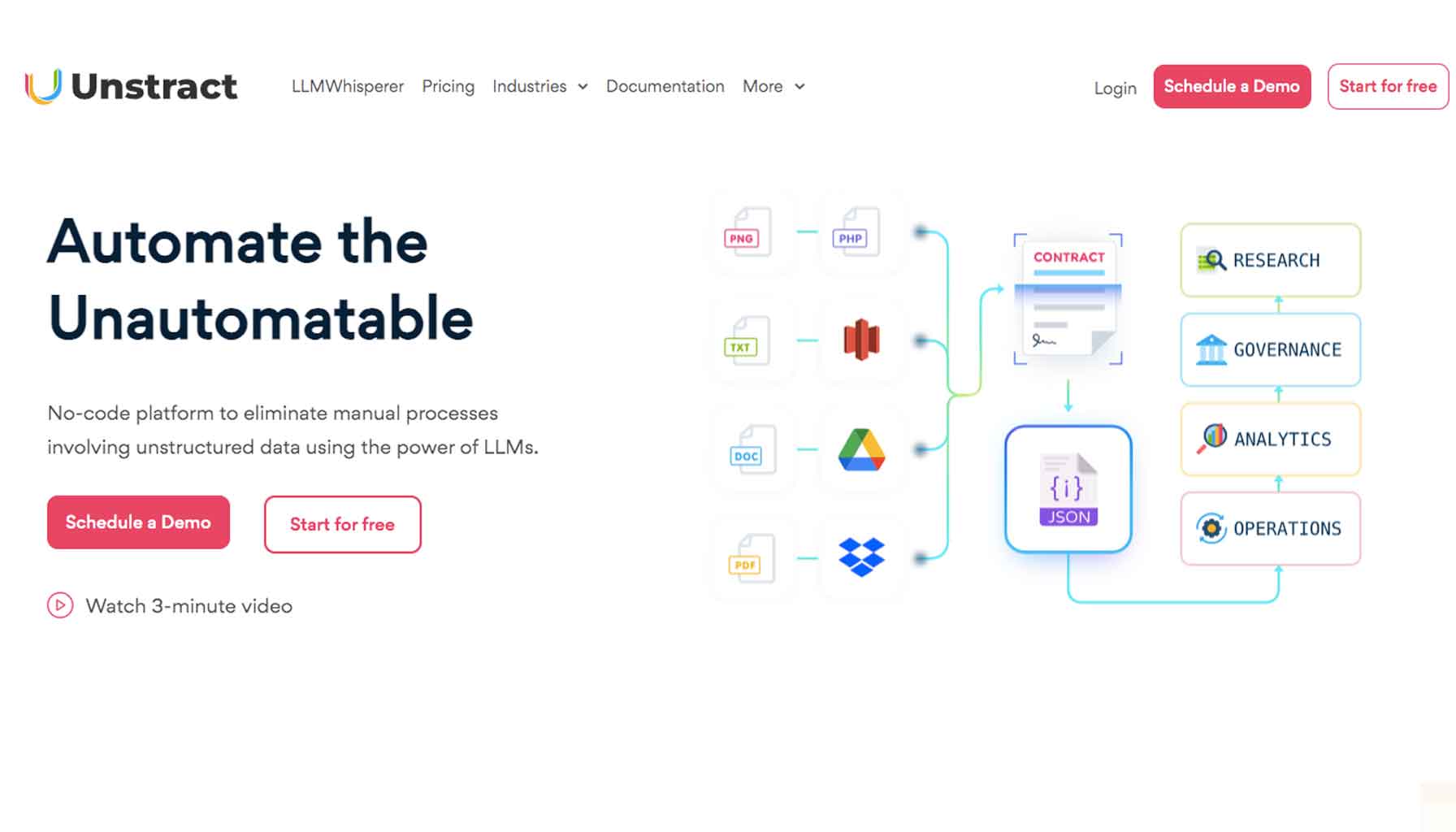

Unstract is an innovative solution that utilizes artificial intelligence (AI) to revolutionize document processing in the insurance industry. By leveraging Unstract, you can:

● Expedite insurance claims processing: Automate data extraction from various document formats, including claims forms, first notice of loss (FNOL), invoices, policy terms and contracts, policy applications, legal and compliance documents, healthcare itemized bills, and KYC documents, significantly reducing insurance claims processing time.

● Enhance data accuracy: Unstract employs AI to extract data from documents with high precision, minimizing errors and improving fraud detection capabilities.

● Elevate customer service: Automate routine document processing tasks, freeing up your staff to provide exceptional customer service and address customer inquiries promptly.

● Ensure automated compliance: Unstract guarantees that extracted data adheres to all regulatory requirements and legal standards.

● Boost profitability: Automating document processing saves time, resources, and costs, leading to an overall increase in the profitability of your insurance business.

● Empower informed decision-making: Access to accurate and reliable data extracted by Unstract empowers underwriters to make confident and informed decisions.

● Reduce manual intervention: Streamline workflows by automating many routine document processing tasks, allowing your staff to focus on more strategic and value-adding activities.

Key Features:

● Unify automation across unstructured data: Automate any process involving messy, free-form data with a single solution. (combines versatility and eliminates manual tasks)

● Effortless automation with zero coding: Boost efficiency without writing a single line of code. (highlights no-code platform)

● AI-powered processing with built-in intelligence: Leverage cutting-edge large language models (LLMs) to automate tasks like insurance claims, underwriting, and KYC checks. (integrates LLMs and specifies use cases)

● Advanced data validation with built-in trust: Ensure extracted data accuracy with technology like LLMWhisperer and LLMEval, specifically designed for LLM outputs. (focuses on LLM validation)

● Streamlined integration for existing workflows: Connect your unstructured data workflows seamlessly to existing applications through APIs. (emphasizes API integration)

How to Apply:

1. Claims Processing: Unstract automates insurance claims with AI, streamlining data extraction and validation for faster processing.

2. Underwriting: Unstract’s LLMEval technology ensures accurate data extraction in underwriting, improving risk assessment for insurance and finance.

3. KYC Processing: Unstract seamlessly integrates with existing applications for KYC checks. LLMWhisperer helps understand unstructured data, boosting compliance and data analysis.

Ideal for:

Insurance carriers, InsurTech companies, Software developers, Business process outsourcing (BPO) providers