Artivatic

A I • May 29,2024

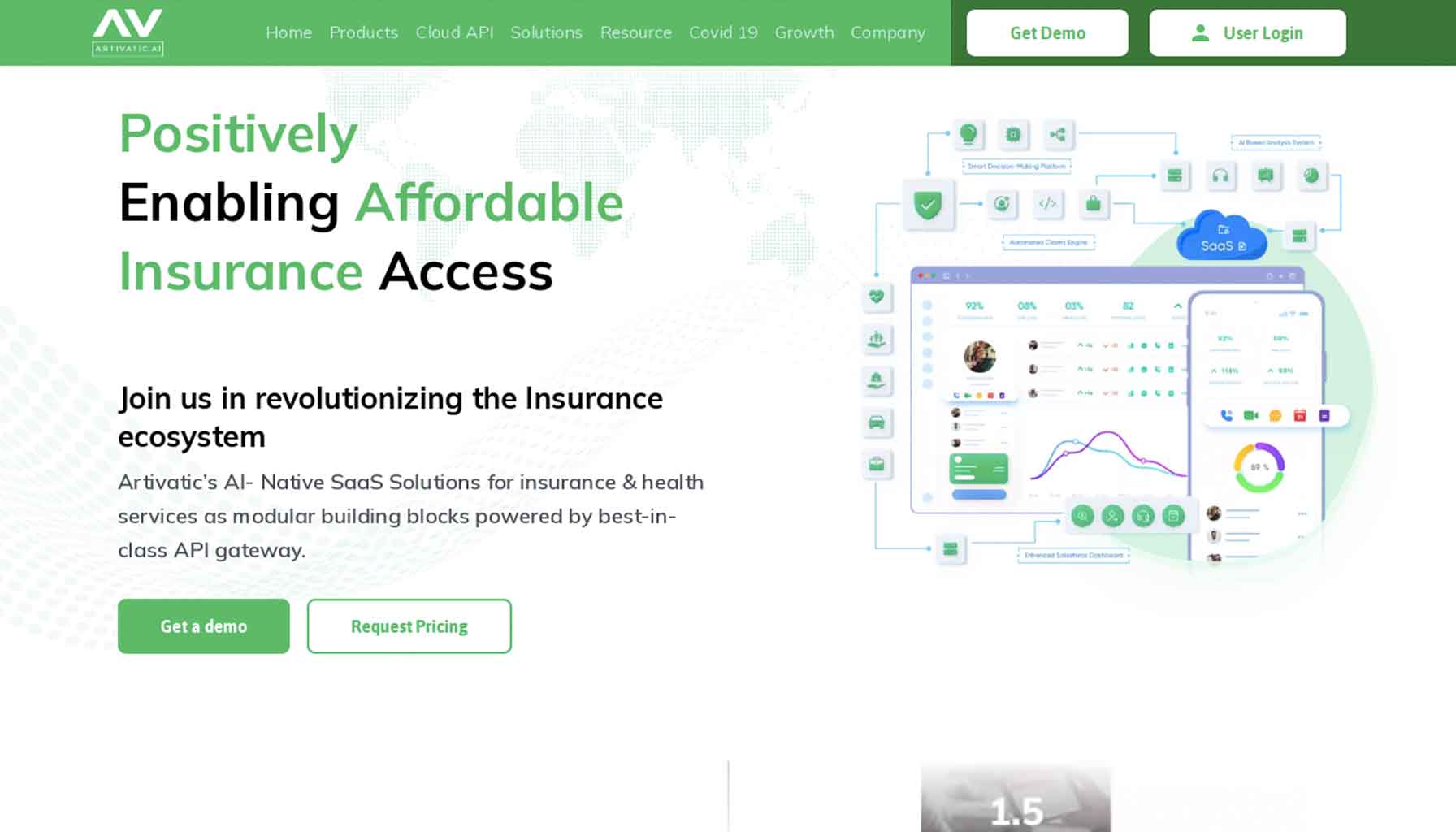

Artivatic isn’t just an AI insurance platform, it’s a revolution. With over 400 cutting-edge APIs, it provides a modernized infrastructure built for the ever-changing insurance landscape.

Streamlined Efficiency, Personalized Experience

Leveraging real-time technology, Artivatic optimizes pricing and tailors the customer journey on the fly. This translates to a smoother, more personalized experience for your policyholders.

Beyond the Basics: A Feature-Rich Arsenal

But Artivatic goes beyond the basics. It boasts built-in OCR/ICR for effortless document processing and analysis. Need to create risk-based products quickly? Artivatic’s risk inspection tools have you covered.

AI Drives Seamless Operations

And for truly seamless operations, Artivatic integrates AI-powered features for lead management, tariff management, and even payments and settlements.

Key Features

● Modernized API Infrastructure

● Real-time Pricing & Personalization

● Powerful OCR/ICR for Document Processing

● Risk Inspection Tools for Faster Product Development

● AI-Driven Features for Streamlined Operations

How to Apply:

1. Streamlined Underwriting and Personalized Coverage: Artivatic streamlines underwriting by analyzing real-time customer data, enabling quicker decisions and personalized coverage for a better customer experience.

2. Effortless Document Processing: Artivatic’s OCR/ICR technology streamlines document reading and analysis, resulting in faster processing, improved accuracy, and substantial time savings for your team.

3. Risk-Based Products Made Easy: Artivatic’s risk inspection tools simplify the creation of tailored, risk-based insurance products. This enables precise coverage options with quicker turnaround times, enhancing operational efficiency.

Ideal for:

Insurance companies, Insurance agents, Healthcare Providers, Fintech companies