Keeper

A I • May 05,2024

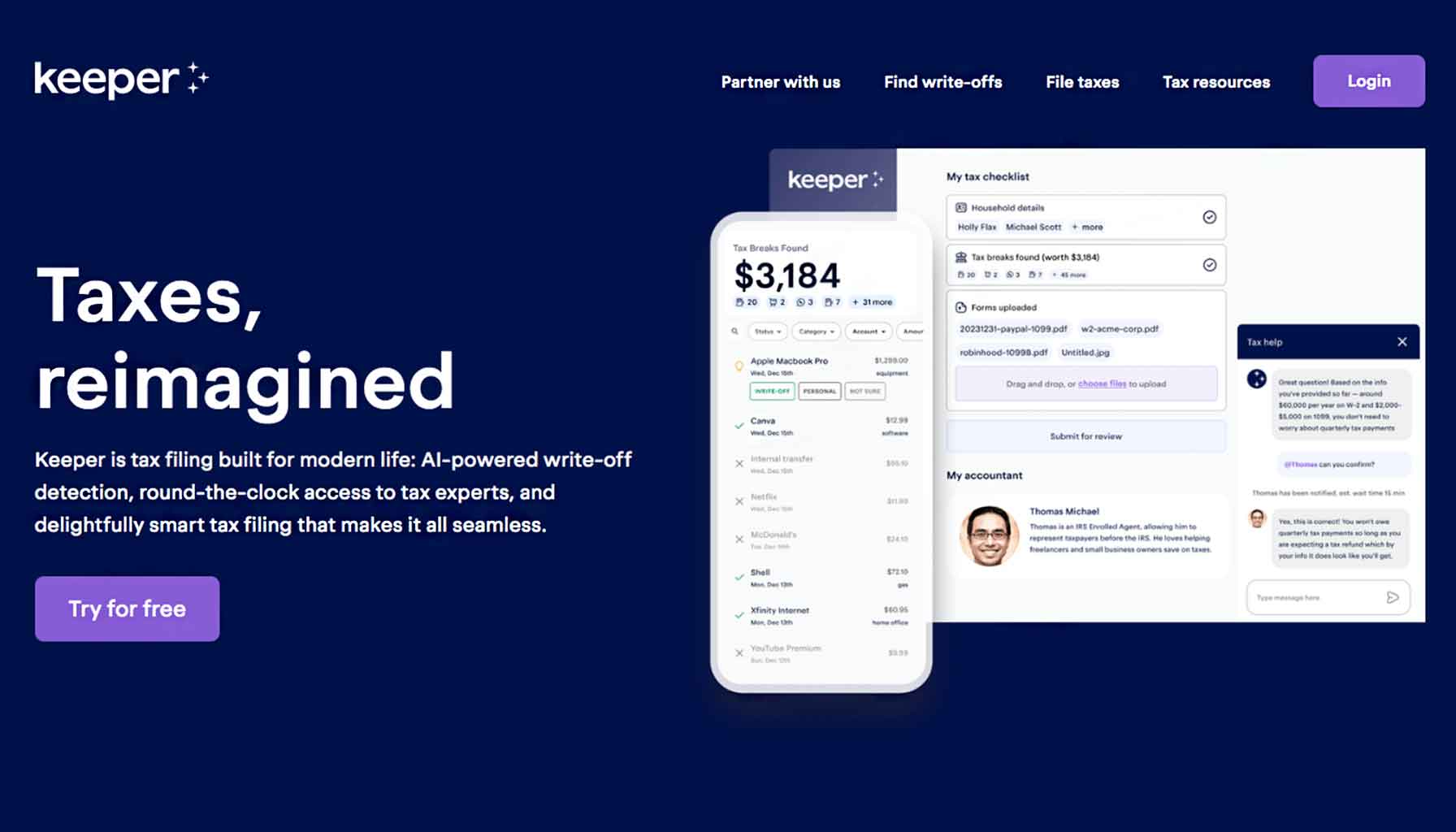

Ask an AI Accountant 2.0 by Keeper is a powerful tool that simplifies and streamlines the tax filing process for individuals and small businesses. It leverages cutting-edge technology to empower users with features like automatic expense tracking and year-round tax bill predictions. These features not only save time but also help users make informed financial decisions throughout the year.

More Than Just AI Answers: The platform goes beyond basic AI-powered responses. Ask an AI Accountant boasts an impressive 96% accuracy rating, exceeding the average human tax professional (94%). Additionally, the AI is constantly learning and improving, thanks to periodic reviews by real tax professionals (CPAs, EAs, and JDs). This human oversight ensures top-notch accuracy and personalized guidance when needed.

Empowering Users with Flexibility: Ask an AI Accountant provides a user-friendly interface for asking tax-related questions and accessing pre-populated answers on a wide range of common scenarios. Furthermore, users can connect with professional tax assistants directly on the platform for personalized advice, ensuring they tackle complex tax situations with confidence. The ability to file taxes directly through the platform with both IRS and state authorities adds another layer of convenience to the entire process.

Key Features:

Automation:

● Automated expense tracking: Sync your bank or credit cards to automatically add receipts and bills.

● Year-round tax bill predictions: Get updated tax bill predictions throughout the year for better financial planning.

Enhanced Accuracy:

● 96% AI accuracy: Get reliable answers to your tax questions from AI with impressive accuracy.

● Fact-checking by tax experts: Human tax experts (CPAs, EAs, and JDs) periodically review AI responses, ensuring additional confidence.

User-Friendliness:

● Knowledge base search: Search and find answers to common tax questions.

File taxes online: File taxes directly from the platform with both IRS and state authorities.

● Connect with tax assistants: Get personalized advice from qualified tax assistants through the platform.

How to Apply:

1. Demystifying Taxes:

Scenario: You’re unsure how a specific income source (e.g., side hustle, freelance work) impacts your taxes.

Solution: Ask an AI Accountant 2.0 provides a searchable knowledge base with answers to common tax questions. You can also connect with a qualified tax assistant through the platform for personalized guidance.

2. Error-Free Tax Filing:

Scenario: You’re worried about making mistakes while filing your tax return.

Solution: Ask an AI Accountant 2.0 guides you through the filing process. It can automatically import your tax data (with your permission) and ensure proper calculations.

3. Maximizing Tax Benefits:

Scenario: You’re unaware of all the deductions you might qualify for.

Solution: Ask an AI Accountant 2.0 analyzes your income and expenses to identify potential deductions you might be missing. It can suggest relevant categories like charitable donations, home office expenses, or student loan interest.

Ideal for:

Individuals, Tax Professionals, Small business owners, Accounting professionals

Previos Article Fdo.Ai

Next Article SparkReceipt